maryland earned income tax credit 2019

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit.

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

Maryland earned income tax credit 2019.

. 2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits 10-704. Allowing certain individuals to claim a refund of. In addition the legislation increases the refundable.

Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. Some taxpayers may even qualify for a refundable Maryland EITC. The state eitc reduces the amount of maryland tax you owe.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Reduces the amount of Maryland tax you owe. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit.

Allowing certain individuals to claim a. 15820 21710 married filing jointly with no qualifying children The payments provide 178 million in relief to 400000 Marylanders. If you qualify for the federal earned income tax credit and claim it on your federal.

30 1 i the numerator of which is the maryland adjusted gross. In 2019 86000 Maryland workers paid taxes this way and 60000 of them had incomes low enough that they would have qualified for the tax credit if allowed. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than.

For 2019 the maximum Earned Income Tax Credit per taxpayer is. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than. 529 with no Qualifying Children 3526 with one Qualifying Child 5828 with two Qualifying Children 6557 with.

For earned income For earned income Universal Citation. If you qualify you can use the credit to reduce the taxes you owe. Its free to sign up and bid on jobs.

Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit. Allowing certain individuals to claim a refund of. MD Tax-Gen Code 10-704 2019.

This alert addresses changes brought by passage of Chapter 40 of the Acts of 2021 concerning Income Tax Child Tax Credit and Expansion of the Earned Income Credit. Allowable Maryland credit is up to one-half of the federal credit. 1 PDF editor e-sign platform data collection form builder solution in a single app.

Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. The local EITC reduces the amount of county tax you owe. Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit.

Allowable Maryland credit is up to one-half of the federal credit. Ad Download or Email MD 502D More Fillable Forms Register and Subscribe Now.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Summary Of Eitc Letters Notices H R Block

Filing Maryland State Taxes Things To Know Credit Karma Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

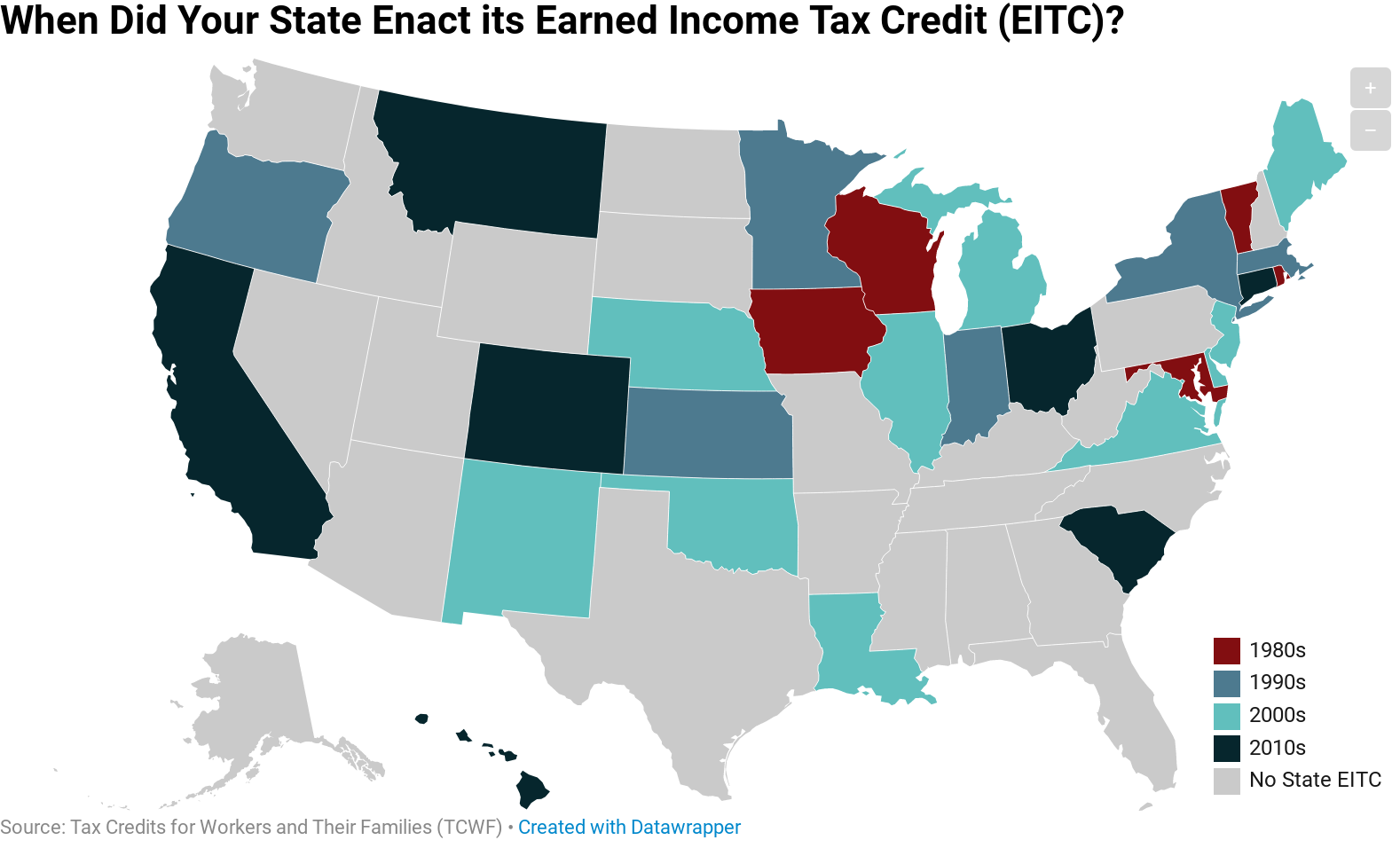

When Did Your State Enact Its Eitc Itep

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco

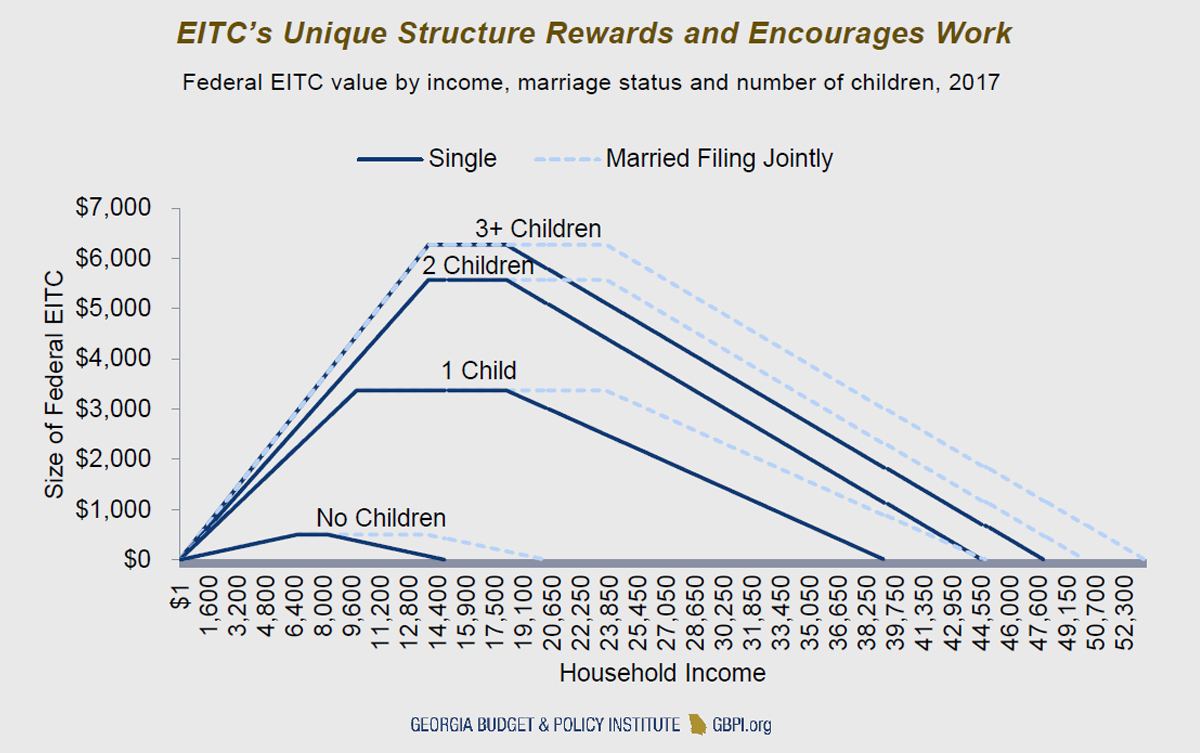

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Differences Between Va Md And Dc Taxation Lipsey Associates

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Earned Income Credit H R Block

Irs Child Tax Credit Payments Start July 15

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Governor Hogan S Tax Relief Package State Local Fiscal Effects Conduit Street